Asset allocation refers to the distribution of assets across various asset classes such as bonds, equities, real estate, currencies, and precious metals. The EU's »Solvency II« directive provides the framework for the necessary capital requirement. On this basis, we have developed and implemented an innovative new approach to strategic asset allocation with R+V Lebensversicherung AG.

Strategic Asset Allocation (SAA) and Portfolio Optimization

Multi-Criteria Optimization Provides Efficient Solutions, Even for More Than Two Criteria

At least once a year, many companies are faced with the question of how best to invest their available capital in the coming year. The term »best« covers several areas in which the respective objectives must be reconciled. Insurance companies in particular often aim to achieve the highest possible long-term return at a defined level of risk. On the other hand, however, a specified liquidity (i.e., availability of funds) should also be guaranteed within various time periods, for example.

Strategic asset allocation (SAA) determines the desired long-term composition of a portfolio based on mathematical theory. Possible asset classes in the investment pool are

- Shares

- Bonds

- Real Estate

- Financing

possibly divided by region or risk profile.

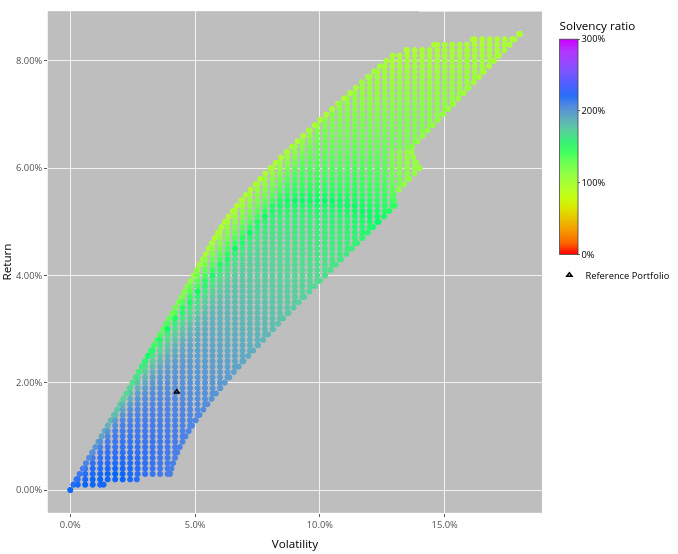

In classic portfolio optimization according to Markowitz, only return (mean value) and risk (variance) are taken into account. Accordingly, a so-called efficient portfolio exists if its return can no longer be improved without increasing the risk. To select the asset allocation, a set of efficient portfolios is determined. This gives the investor an overview and enables him to select a portfolio that matches his risk profile.

In 2009, the EU issued a directive known as »Solvency II«, which has been binding for all insurance companies since 2016. Solvency II places particular demands on the company's capital adequacy and is therefore another important target function in asset allocation.

Multi-Criteria Solution

Together with R+V Lebensversicherung AG, we have implemented a new approach to strategic asset allocation. On the one hand, this takes into account the solvency ratio as part of the Solvency II regime. On the other hand, our approach allows to consider other relevant portfolio characteristics.

For a given set of portfolio characteristics (criteria), we calculate efficient portfolio allocations that cannot be further improved in any of the criteria without deteriorating in another criterion. In doing so, we ensure that the efficient space is covered as evenly as possible.

In a second step, we can further restrict the decisive criteria and thus examine certain regions of the efficient space more closely with a further optimization. This multi-stage approach enables precise solutions to be found almost in real time, which were previously only determined through lengthy trial and error.

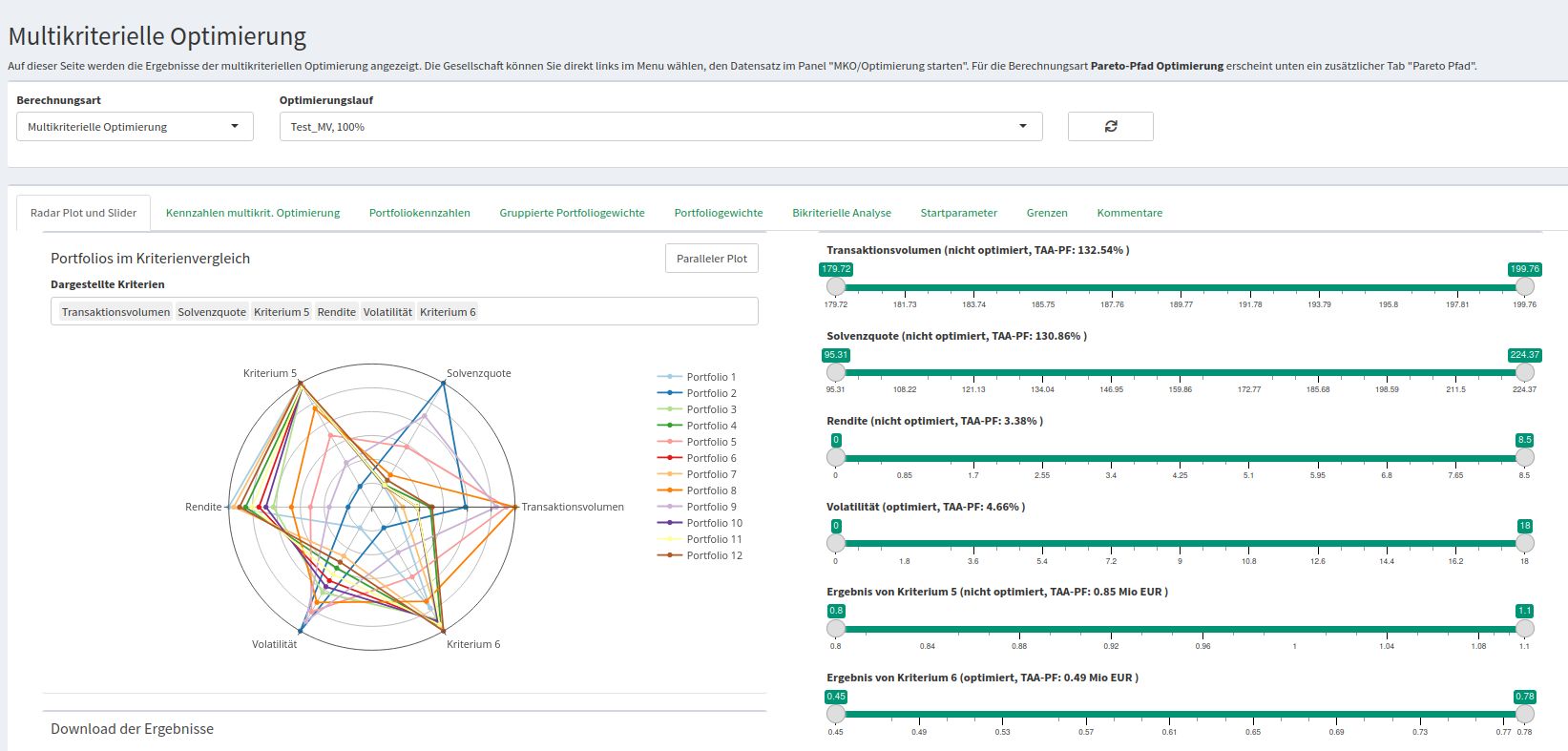

User-Friendly Visualization

As a user, you interact via a graphical user interface, which is individually implemented using a web server and completely separated from the calculation core. This allows you to analyze the results of the calculations quickly and easily in your day-to-day work. The visualization maps all efficient portfolios, integrates additional constraints, and shows variants. This enables you to dynamically select a portfolio that meets your requirements and appears to be the most suitable from the set of optimal portfolios. The program shows the composition of the portfolio as well as a range of other key figures, such as reallocation, diversification, value at risk and behavior under stress scenarios.

Greater Automation Planned

Users can import data records with asset classes and weight limits via the interactive web interface and start optimizing the portfolios. The results can be exported to Excel, for example, for additional analysis. In addition to interactive decision-making, the process can also be used automatically to process a large number of different data sets in parallel.

Wide Range of Possible Applications:

The concept of multi-criteria optimization also provides effective solutions in other situations.

- Investment Optimization – return versus risk with the lowest possible solvency ratio

- Procurement Strategies – costs versus flexibility with the lowest possible value-at-risk

- Model Calibrations – best fit versus long-term stability with the most regular possible time trends

QuSAA – Quantum Algorithms for Strategic Asset Allocation

In our project »QuSAA«, a team with expertise together with our project partners is now investigating possible new ways of asset allocation with quantum computing (QC).