Three-Factor Model

The model is mainly based on the following components:

- Non-stochastic seasonality

- Long-term trends

- Mean-reverting, short-living price fluctuations

- Spikes

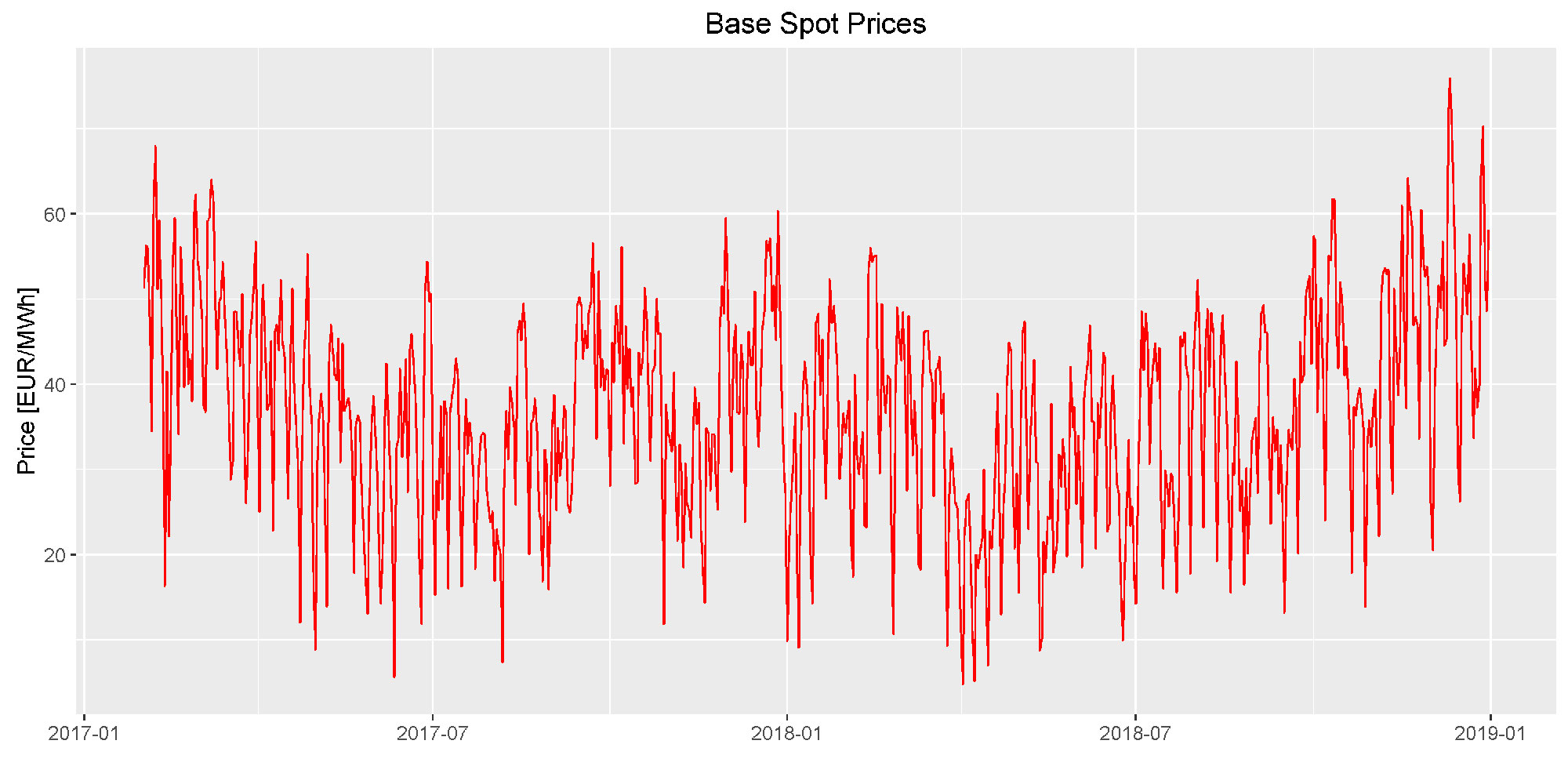

The three random processes are also called factors and they determine the behaviour of the commodity prices. With the interaction of these components all important characteristics of the spot and futures prices can be depicted in the model.

The mean-reverting price fluctuations and spikes are mainly relevant for the spot prices. The futures prices are driven by the trend component (except shortly before the delivery period). Spikes, positive as well as negative ones, occur rarely but are short-lived, irregular jumps upward or downward, relatively, followed by a quick return to the regular level. In the model, weather dependent fluctuations are depicted by short-lasting fluctuations.

With the help of the correlation between single factors, the correlation between the different commodities is simulated. In practice this means, that the energy prices will increase in long-term when the gas prices will do the same.