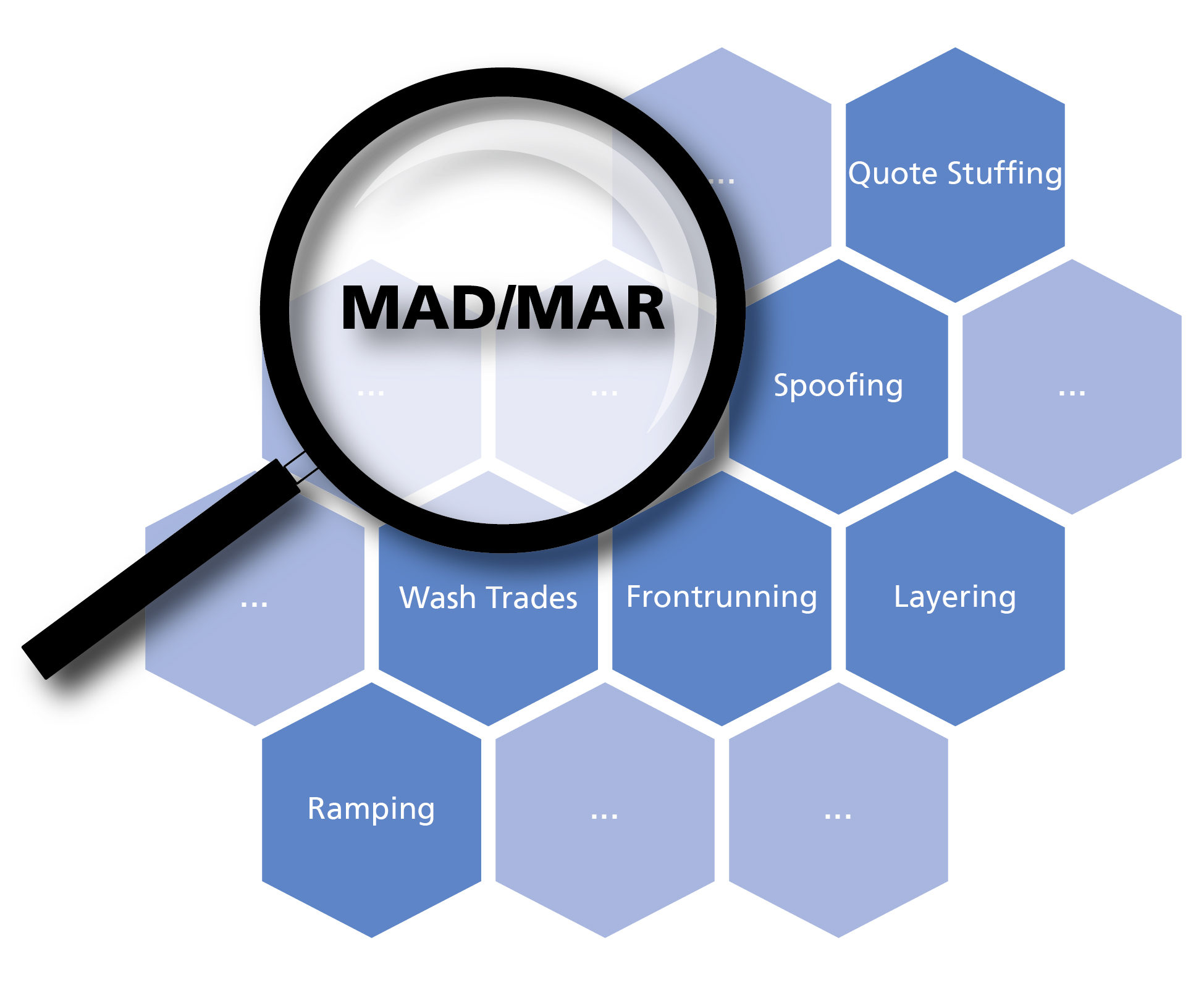

Besides the classical financial industry, MAD/MAR affects companies or business areas, which are not perceived as banks, financial service providers or similar. Among them are for example energy suppliers. This stems from the formulation of the Market Abuse Regulation that trading in financial instruments, including emission certificates and commodity derivatives, obliges one to act.

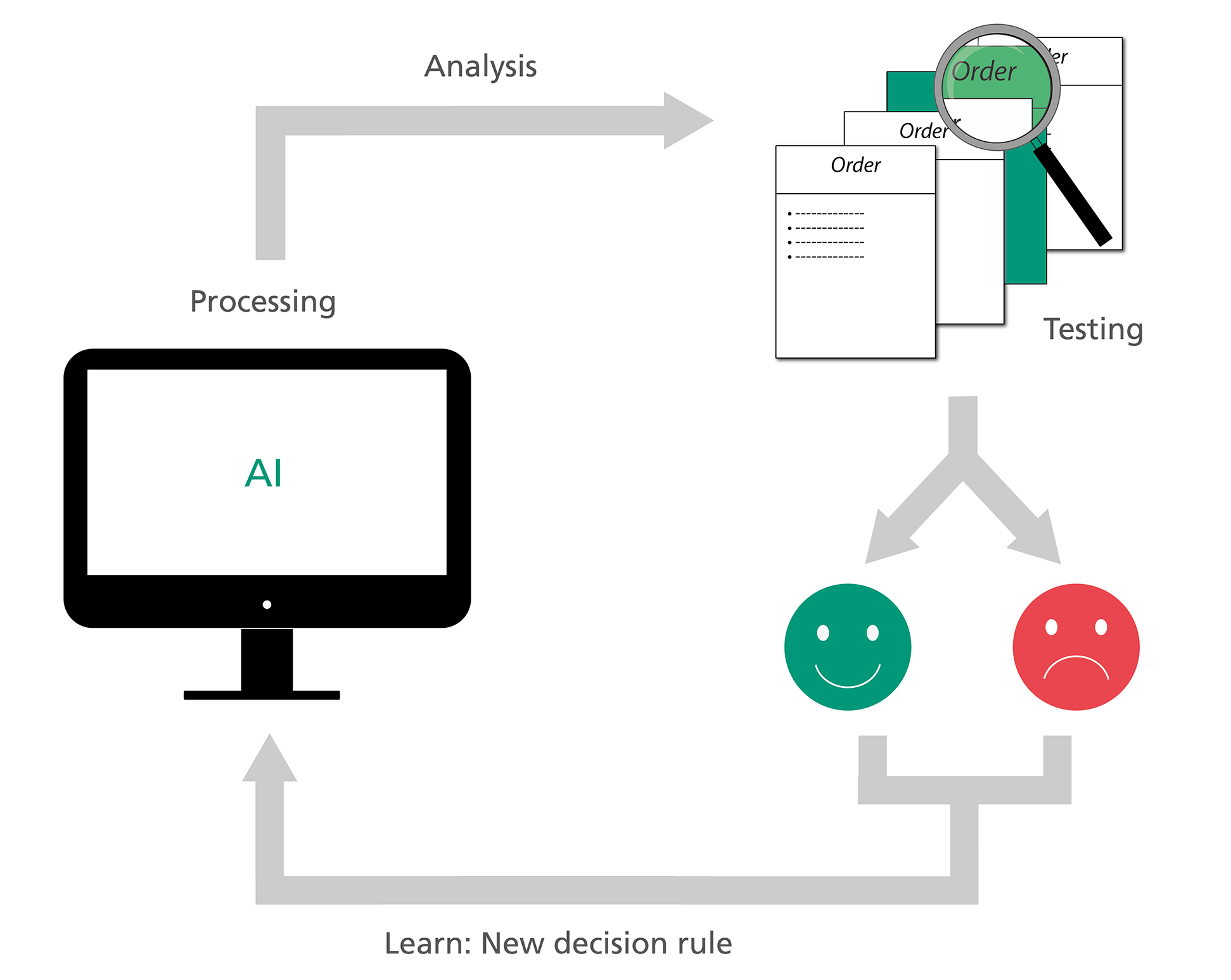

Our financial mathematics department has many years of experience in the energy industry and anomaly detection. Among other things, we have developed the Commodity Risk Manager –an industrially approved tool for daily risk reporting - and implemented it at local energy suppliers. The tool is maintained by us and in daily use by our client. Our tools for anomaly detection are also in use for many years. We are constantly developing and expanding both fields of research.

Your Daily Routine Matters

In the following, we show to what extent you, as an energy supplier, are affected by MAD/MAR. We also highlight market surveillance measures you have to take, in order to be able to manage your daily business in accordance with MAD/MAR. In the case of an inspection, you have to be able to prove your approval to the requirements. Failure is considered an offense and will be punished by the enforcing authorities (in Germany the BaFin).