Since 2016, we have been classifying all retirement provision products that are subsidized by state allowances on behalf of the Product Information Office for Retirement Provision gGmbH (PIA).

Since the beginning of 2017, these products require a product information sheet in accordance with the Retirement Improvement Act (Altersvorsorge-Verbesserungsgesetz), which in particular identifies an opportunity/risk class (CRK). The Federal Ministry of Finance (BMF) has assigned the task of defining this CRK to PIA by way of a loan.

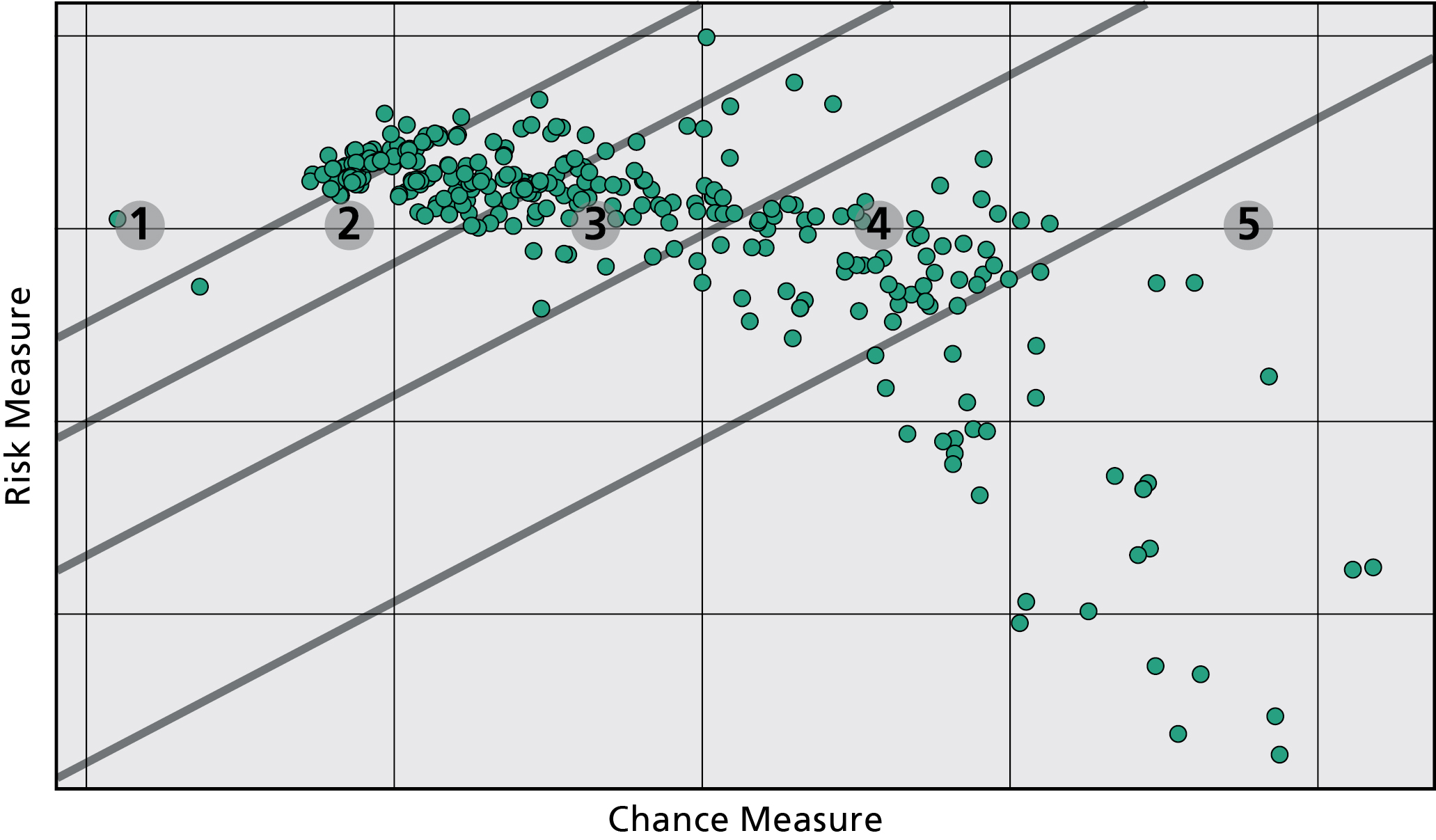

For the classification, possible market scenarios for the entire term of the products are generated on the basis of a market model for interest rate and share price development (PIA basic model) developed by us. Classification into one of five risk/reward classes is relative to reference portfolios, which determine the boundaries between the classes. Like the calculated CRK, these are reviewed annually on the basis of current market data.

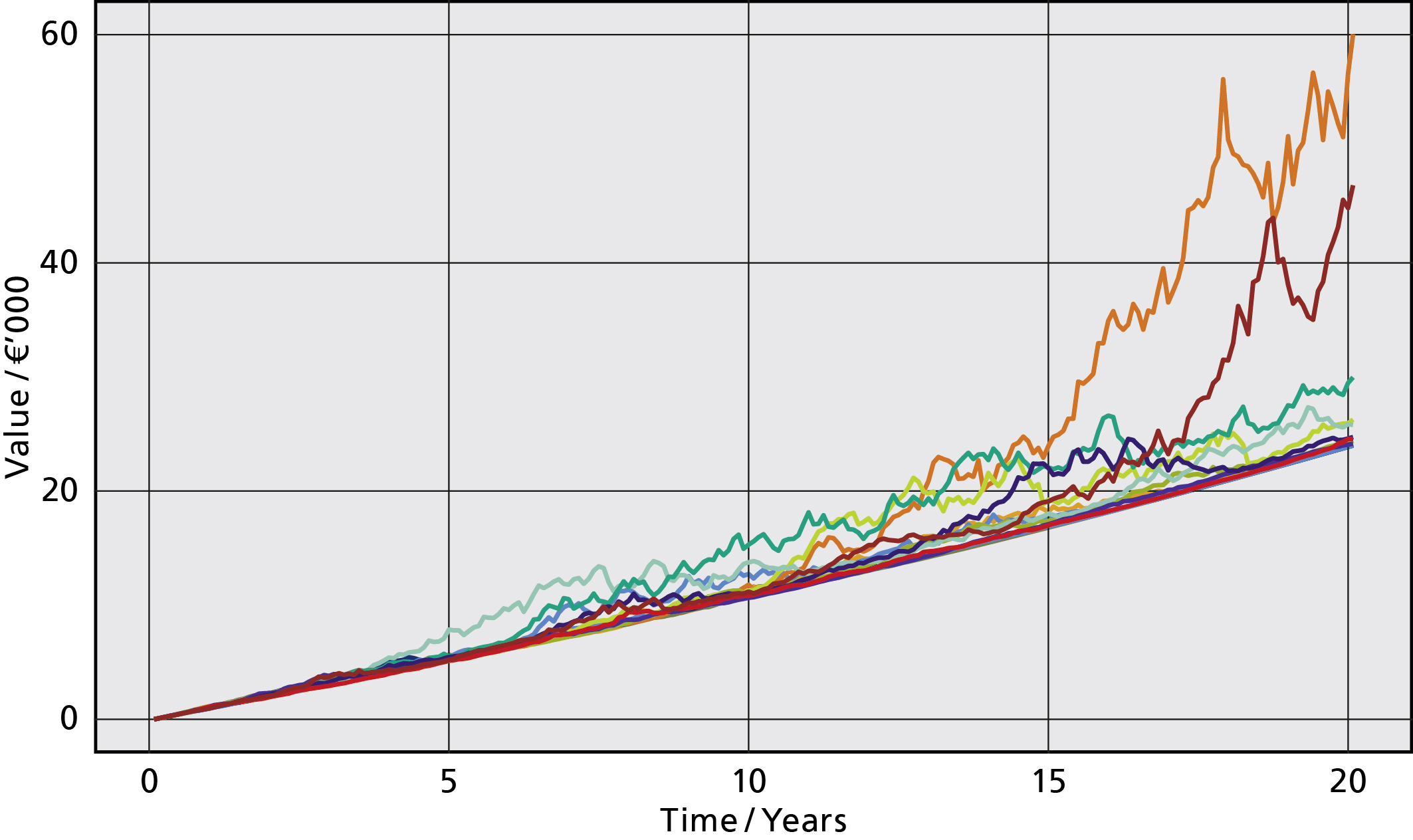

The simulation takes into account the chosen contract form (classic life insurance, fund savings plan), the investment decisions of the management and the retained costs. According to the law, these scenarios are generated for sample customers with a time horizon of 12, 20, 30 and 40 years, who make monthly or one-time payments at the beginning of the contract.